Thanks for joining me!

Good company in a journey makes the way seem shorter. — Izaak Walton

Thanks for joining me!

Good company in a journey makes the way seem shorter. — Izaak Walton

This month’s installment is a funzie-wunzie introduction to The Wise Sage. Each segment will feature an older, wiser sage giving money advice to all y’all.

This month’s wise sage: my very own father. He’s the kind of guy that has other people's children named after him, and he gives advice on which you can base your life decisions. Plus, he reads approximately 3,204 pages of news per day, much of that including economics and personal finance, so that helps too.

We also lived on one income on purpose. We ended up saving more money than some couples that were living on two incomes. It’s pretty tempting to spend a lot of money if you’re making a lot of money, so we tried to cut out that mindset.

“It’s pretty tempting to spend a lot of money if you’re making a lot of money, so we tried to cut out that mindset.”

Also, we were pretty frugal on our car purchases. A car is a depreciating asset (it’s more likely to lose its value) while a house is an appreciating asset (it’s more likely to make you money).

“A car is a depreciating asset while a house is an appreciating asset.”

*Italics added for emphasis.

Everything in moderation. EVERYTHING.

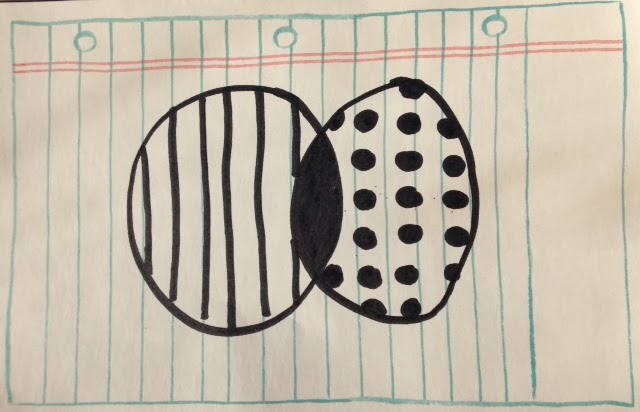

How you spend your money and divy up the budget is no exception. Sammy the saver is good at stocking away a down payment and retirement, but he's a bit of a tightwad when it comes to day-to-day expenses. Stew the spender is good at throwing lavish parties and taking instagram-worthy vacations, but he struggles with putting the shackles on his wallet.

Whether prone toward saving or spending, try erring on the unnatural side just for a bit. There are benefits to spending money and benefits to saving money, and you'll never know the other side until you give it a whirl.

When it comes down to it, money is just a tool. Once we learn the finer points of spending, saving, and making our money grow, then we'll have the foresight to know when it's appropriate to tip with a $20 bill and when we should skip the out-to-eat meal altogether.

Cheers in your money spending and saving!

...And with that, our 10 money tips come to a close!

Want a refresh? Check out the links below.

#1 Don't Spend More Than You Earn

#3 Track Your Day-to-Day Spending

#5 Drive a Used Car – Part One

A few weeks ago, car guy husband and I took a little trip to Vancouver, Canada. We stayed in a four-star hotel. We saw sights and sounds and had a few rounds of drinks. We even went hot-tubbing. Oh, and Vancouver is the most expensive city in North America. More pricey than NYC, costlier than LA. Ok, now that we sound spoiled and snooty, let's be honest: we're cheap. And I was unemployed. So how can we pull off an awesome weekend at 50% off? Let's look at the numbers; First the expensive normal prices per couple and then you'll see how much we actually paid.

And that's not even counting the $60 duty-free perfume I was lusting over!

Grand total: $489

($549 if hunky husband was feeling generous and wanted to buy me perfume)

But Sage & Mint, you might say, I'm young and wild and free, my bones don't creak yet and I don't have little chilluns running around, and THIS IS THE TIME TO TRAVEL.

You are so right, fretting reader. Here's how we do it:

Let's go back to that first sentence. Last weekend car guy husband and I took a little trip to Canada with OUR AWESOME COUPLE FRIENDS THE HOGANS. They're great. We travel well together. They're in grad school for counseling, so they're excellent at both communicating and listening , and this is key to our travel smoothness.

Right. So this basically means our couple of two turns into a party of four, and we split the cost of everything. So then we stayed in a four-star hotel that we found on Hotwire.com that was basically half off. We shared a hotel room on the 34thfloor of a Hyatt with a wall-size window looking out over downtown Vancouver.

We split the cost of gas. We found cheap parking,* and for a string of non-cheapness, we had a normal dinner and drinks afterward (see, we still have fun). OUR AWESOME COUPLE FRIENDS THE HOGANS went to Trader Joe's prior to the trip and stocked up on snacks, so we basically skipped buying an entire breakfast, lunch, and dinner at a restaurant. I didn't buy that perfume that I was lusting over, even though I still want to.

Actual prices per couple:

And yes, I'm going to do that mastercard thing, I know you were waiting for it:

A weekend with friends adventuring in a new city: PRICELESS

Grand total: $234 + priceless

Muuuch more manageable. Yes, it's a splurge fo sho, but if you've got some pocket change, why not take a vacation!

A few travel gems:

Now for a few warnings:

*You get what you pay for. Turns out our cheap parking was cheap for a reason. (Side note, this would've made our weekend way more expensive but we are forever grateful for company cars.)

There ya go: International travel on the cheap!

Expect plenty more on the travel front. Ski trips, camping adventures, exotic locales. At Sage & Mint, we lurv to travel. I bet you do too. Got any tips or tricks to share?