Thanks for joining me!

Good company in a journey makes the way seem shorter. — Izaak Walton

Thanks for joining me!

Good company in a journey makes the way seem shorter. — Izaak Walton

We all wish it would be our bank accounts that would gain a few pounds this holiday season, but alas, that's usually not the case. Here's a list of 15 ways to keep your wallets a little plumper.

Make a list of all the people to whom you'll give a gift (naughty and nice points optional). Along with gift ideas for each person, jot down a ballpark cost of each present. Then, tally all your costs up and adjust your gift giving accordingly so you don't break the bank (you might end up shooting for gifts $10 cheaper than originally planned, for instance). Seeing the big number on paper could help set your gift giving to budget-friendly levels.

I love all the extra trimmings for Christmas, don't get me wrong, but they do cost a few dollars. Don't forget about added costs like a tree, new clothes for a holiday party, cute gift wrapping, Christmas cards, and extra food and drinks for holiday parties. If you're looking for ways to trim the budget, this area is ripe for slimming. Consider getting a smaller tree or you could look for your new dress on a discount site instead of buying it full-price at Nordstrom.

When you're shopping around and see a great deal on something cute and general like candles, lotions, notebooks, etc., pick up a couple and store them away for a rainy day (or more likely for a snowy one). I inevitably forget someone or am surprised by a gift and it's nice to have something stress-free and sweet on hand to give in return. If you don't have this problem, these little gadgets make nice hostess gifts as well.

It's not too late for Cyber Monday gems. Companies are most likely doing deals around this time of the year, and if you're on the email list you'll be the first to know. It's a quick and painless way to get discounts and you can unsubscribe whenever you want.

Thanksgiving comes at an ironic time to the holiday shopping season. Don't forget the simple joys of being with family and all the things you have to be thankful about (and sometimes that new pair of shoes becomes a little less important).

If you don't have a lot of decorations, 1. that's totally ok and 2. if you want more holiday decor, you could save a lot of money if you wait to buy it until after Christmas and save it for next year. Instead of buying them full price at the beginning of December, you could try to wing it this year with homemade things (snowflakes! candles!) and then buy decor for next year a few days after Christmas when everything is at a steep discount.

This probably won't fly as well with families or for office exchanges, but if you're trading gifts with a group of friends you could try to make it a regifting exchange. Bring a wonderful or horrible present that you already own and trade for something equally wonderful or horrible. The costs are low and the stories are rich.

Plan on a high spending month. It's Christmas. It just happens. If you have any side gigs or freelancing talents, this is your month. Be a dogwalker, babysit, sell something you made, sell your old clothes on Poshmark, get creative. Any extra income helps offset the added costs of this (wonderful) season.

The earlier you finish shopping, the less likely you'll be to binge spend in the final hours of gift buying. Give yourself enough leeway to shop around for deals and to buy your gifts in a less stressful environment than the final hours of Christmas Eve.

If you haven't discovered the magic of Amazon Prime yet, this is your year. It's the best. You add things to your cart and let them sit while you think on it for a night. You click a button to buy, and it arrives to your doorstep two days later. This saves money from multiple angles: Amazon usually offers great prices, it protects against impulse purchases, and you save time by shopping online and having it delivered (and time is money). Win, win, and win.

Two pluses here: 1. Experiences are usually better than gifts. 2. If you're cutting it close, sometimes giving experiences delays you actually purchasing something for the other person (for example, if you're treating your friend to dinner, you might not actually shell out the cash until you and your friend go out, most likely a few weeks after Christmas. This gives you a few extra paychecks of buffer after the Christmas spending hangover).

Wait until after Christmas to buy yourself presents. You might not be able to resist (I'm very guilty of this), but it is a highly logical way of spending less money this holiday season. Plus, you don't run the risk of buying yourself something that someone else was going to give you.

Creative presents usually mean a lot and they often are a cost-effective approach to give giving. Pinterest is a candy store for this kind of clever gifting, but here are a few other ideas to get your thoughts rolling: make a photobook, write your own children's book, make and give freezer meals, write a letter every month to someone, clean someone's house, detail their car, give your time and muscle to help a relative clear out junk or on house projects; come up with you own!

You don't have to do every Christmas thing ever. Really: your Christmas won't be ruined if you miss your cousin's Christmas pageant or if you didn't send out a holiday photo card. Sometimes it's best to slow down and relax. It's usually friendlier on the wallet too.

It'll make you rich every time. Don't think of giving only things that cost money. Giving comes in many forms: giving your time, giving your resources, giving your talents. Christmas is best enjoyed when we keep that in perspective and focus on what we can give rather than what we can get.

Happy holidays everyone!

I’ve delved deep into the world of health insurance quite a few times, even more so after having some major ankle surgeries. I’ve delved, my friends, I’ve delved. It was a painful and frustrating learning process and insurance is CONFUSING. First, let's talk about acronyms. These are a sampling of healthcare options out there that you may be waffling between. Let me pass on the translations I've learned so far:

Health maintenance organization (HMO):

In this insurance setup, you’ll have your primary care doctor as your go-to. Everything else (think specialists, hospitals) is set up through that doctor. It’s a very common plan and generally lower cost than its close cousin, the preferred provider plan (PPO), which doesn’t have a set home base/primary care doctor.

HMOs might be great for you if:

You’re predictable! You’re consistent!

Your cup of doctor tea is just a regular old checkup. No fuss.

You’re thinking about having a baby sometime soon (they’re expensive and you want all the insurance coverage you can get).

On a PPO plan, you’ll have a whole gang of health care providers and you can go to any of them without a referral. Think of HMO as one BFF and PPO as a giant friend circle.

PPOs might be great for you if:

You visit specialists.

Your medical regime isn’t always super predictable and you want flexibility without the fuss.

You’re prone to emergency health issues.

You’re thinking about having a baby sometime soon (just to reiterate: they’re expensive and you want all the insurance coverage you can get).

This plan is refreshingly clearly named. With an HDHP, insurance kicks in only after you’ve paid your full deductible (usually somewhere in the $1200 range for singles and $2500 for families). Frequently, you’ll see these plans paired with a health savings account (HSA) that allows you to contribute funds tax-free for any medical expense (such as meeting the aforementioned high deductible).

HDHP might be great for you if:

You’re young!

You’re in good health!

You don’t have any recurring medications!

You’d rather take a little risk with a high deductible if it means lower costs and possibly saving money (that is, if you have an HSA too).

When it comes right down to it, choosing a health plan is not clear cut or intuitive. Do the math. That’s right. Crunch the numbers for each health plan and your anticipated expenses in the next year to help make your decision. You’ll feel really grown up and you officially get five gold stars for being an adult.

Call the customer service line. Call often, call quickly, and don’t hesitate. Insurance is really confusing to twenty-somethings (and thirty-somethings, and forty-somethings, and probably everyone)—and no shame, there wasn’t a formal training you missed. Getting on the phone with a service representative will really help make sense of your plan and anticipated costs. I once called my insurance company and the guy on the other line was so helpful he walked me through how to bill my insurance for a recurring appointment so it was $25 instead of $150 per visit. That saved me a LOT of money. It’s worth giving them a ring.

If you’re on a PPO, know your copays, deductibles, and out-of-pocket maxes. It should be on your insurance portal or the thick packet you’re given when you start a job. If you don’t know, call them! Figure out what counts toward your deductible and when you’re going to hit it. I hit my out of pocket max mid-way through the year after an ankle surgery and was able to get the second ankle surgery (billed to insurance at a whopping $28K) virtually free because I had already hit my max (and I don’t wish two ankle surgeries on anyone). Know when you hit your limits and plan your surgeries accordingly!

For recurring prescriptions, try using mail-order pharmacies. They’ll often offer a discount for recurring prescriptions (like birth control).

For you HSA folks out there, it’s good to remember that you get to keep your money, even if you switch jobs. The money you put into an HSA is tax free, and some folks even suggest treating it a little bit like a retirement savings vehicle. Put money into it consistently while you’re young and you’ll be able to use that money when you get old and inevitably have some health needs.

Look into temporary health insurance if you’re going to have a gap between jobs or life events. Plans start at as low as $28 a month and this gives you peace of mind in between insurance coverage. Even if it’s only a month, look into temporary coverage because unexpected health crises can easily suck up all of your savings.

Life is full of numbers to track of: you probably know your car's gas mileage (I get an efficient 29 mpg), the cost of your favorite drink at Starbucks (a painful $4.40), and how much you saved on a new fall coat ($30—woot). But do you know the numbers that really matter about your money? Take a moment to answer these three big picture questions about your personal finances.

How chubby are those paychecks when they hit your bank account? Sadly, it's going to be much slimmer than your salary divided by 12 because of things like taxes, health care, and retirement savings. To find your monthly take-home pay, look at your bank account and add up your income for the month.

She's a bright-eyed college grad living it the city with a weak spot for twice-baked almond croissants. She makes $45,000 per year as a graphic designer. It's both the richest she's ever been and also the most broke—this is the first time she's had to pay for life on her own.

Sarah gets paid twice monthly, and she ends up with $1,250 per paycheck after taxes, benefits, and retirement savings.

Thus, Sarah's monthly take-home pay is $2,500 per month.

(An important note: you might have the same salary as Sarah and take home a different amount because tax rates, benefits, and retirement savings vary so widely).

Obviously every month will be a little different, but you should have a rough idea of how much money flows out of your bank account. You see where I'm going here? Once you know how much you make and how much you spend, you'll have a solid picture of your finances: if they're heading for sunny skies or dark clouds of doom.

The easiest way to find your monthly expenses is to take your bank or credit card statements for the last 12 months and find an average amount spent. Don't forget to add in items that might not appear in a statement like student loans or rent. If you don't know that number yet, take a moment to find out...or even schedule time on your calendar to dig in. It's a really good number to know.

Now Sarah has two numbers: she makes $2,500 and spends $2,100. She's a savvy money maven and does a great job of spending less than she earns, but geesh, life is expensive!

Let's forget about big debts like student loans and mortgages, and disregard money that's tied up in retirement accounts or home equity. This should be purely liquid money that can flow like honey when you need it. Don't forget to subtract out credit card debt if you have any (yikes...get rid of it ASAP. Check out two approaches here). Here's your equation: take your bank account balance (both checking and savings) and subtract your credit card debt to find your liquid money.

She has about $4,500 in the bank and $800 on her credit card. After paying her credit card, she has $3,700.

Sarah gets some solid points for having a buffer in her bank account. A savvy financial move is to have $1,000 saved as an emergency fund for unexpected expenses. Next month Sarah could get a flat tire. Instead of going into debt to pay for the repair, she can dip into her emergency fund.

Sarah's next money goal is to build up a three-month buffer of living expenses (a cushion for a worst-case scenario like losing a job or injury). Her next money goal is to have $7,300 saved ($1,000 for an emergency fund and three months of living expenses). But first, off she goes to celebrate with a twice-baked almond croissant. Small victories!

How'd you do? Whether you aced it or need to go hunt down some numbers, hats off to you in taking a big step in wrangling your personal finances. Now go forth and be wise with your money!

If you own a pet, it's really nice to know about Rover.

Rover is basically an Airbnb, but for pets. You can schedule walks, workweek check-ins, or boarding services while you're away and regular people will take care of your precious pet.

The website is sleek and easy to use; prices range from $25-$30 for a night of boarding (it may be higher in different areas), and it comes with a very reassuring insurance policy. That last point had car-guy husband sold.

If you're intrigued, you can check out the site here (and of course, if you book through that link I get $20 for future services and you get $20 for your first booking. Yay).

If you prefer the personal experience to cold facts, keep on going, dear reader. I'll tell you all about it.

A few months ago, we made plans to go visit family on the East Coast for a solid week. Car-guy husband and I love to travel and tend to go on lots of adventures. We even have our to-go toiletries prepacked and ready to go at a moment’s notice (yuppies, rejoice). But our efficiency in travel took a slight nose dive after Lola the dog joined our team.

So, I got a taste of what fretting mothers must feel like (and don’t take offense in my comparing dogs to babies, let’s be honest...they both involve taking care of slightly helpless but cute creatures and dogs are basically gateways to more responsibility...but I digress). So I had to find someplace to board Lola for a week. Yelp reviews of good kennels are tremendously helpful, but the highly rated kennels were either too far or too expensive ($45 a day just seemed too pricey, especially multiplied by 7).

For Lola the dog in particular, I wanted someplace where she could run around and also be velcroed to another human (Vizslas have the nickname of “velcro dog” for a reason). The solution: peruse Rover.com.

I had heard of Rover from an old coworker who worked there. At the time, I didn’t have a dog and just thought the whole service was cute but kind of over the top. I stand corrected: it's great.

So, I searched sitters in my area that could handle boarding and set my criteria: fenced-in yard, dogs allowed on furniture, and high star ratings.

As a first time user, I took the option to go meet the sitter and see the house in person. I decided not to book my first option (the yard was really small and the sitter flaked out on the meet-up) and instead went with my now go-to choice: my gal Monica (no idea her last name...just that she is a mom of two and a dog breeder on the side and Lola comes home a happy pup after a stay at Monica's).

Booking was easy-peasy and the rate for boarding was $25-$30 per night in my area. It was very comparable to kennels (and often cheaper), but you know your dog will get more personalized attention with a family (velcro dogs rejoice). Rover also has very attractive Premium Pet Insurance so your pet is covered during every stay. Premium Pet Insurance covers vet bills up to $25,000 after a $500 deductible in case an incident occurs while your dog is staying with someone else. This peace of mind won my husband over and even now we often use Rover instead of other options specifically for the insurance guarantee. Plus, like all good sharing economies, a review system is built in to review sitters and read about others' experiences.

So I dropped Lola off at Monica’s house the day we were leaving. It was super easy. I didn’t have to make a specific window like at a kennel and Monica got all the details about what Lola needed (lots of exercise) and what to watch out for (counter surfing). I got picture updates during her stay (including an adorable picture of her daughter and Lola sitting on a bed with the caption "best buds"...my heart mushed a bit). I picked Lola up, happy and healthy, and considered Rover a great success.

Additional notes:

Rover is also great in a tight time situation. We booked a sitter the day-of for a four-hour stay while we were traveling on the other side of the state so Lola could be in air conditioning instead of a hot car.

The first stay with Rover takes a little longer because you're getting to know a new sitter but it's smooth sailing from there out as you can rebook with a now trusted sitter through a super easy website and app.

Want a short-term dog? Sign up for the other side of Rover and be a dog sitter. I have parents that love dogs but aren’t ready for the commitment….I imagine Rover might be a perfect solution to the dog itch.

That link, one more time, if you're now curious: Rover for the win.

This is the third post in a series on the wonderful world of the sharing economy. Check out the first two on Airbnb: hosting and traveling. On deck: the popular ride-sharing service, uber.

Many have already used uber, and this post is mainly directed at those who have not. I found it to be a little more scary to start than the welcoming, picture-filled site of Airbnb (though importantly, no less helpful). To the newbies, I want to say yes, you can use uber. It's easier than hailing a cab and cheaper too.*

My first uber trip was out of necessity (as was my second trip and my third), which is what makes this sharing economy so clutch. I had a pretty intense ankle surgery and couldn’t walk or drive. I had to make it to work which was only a MILE AWAY. Before uber, what would I do? Ask my husband to stay home from work to take me? Ride a knee scooter with marginal brakes down a very steep hill? Call our retired friends who live 40 minutes away to come and get me? No good options. So I signed up for uber and took my first trip. It was super easy and incredibly convenient.

Thank you!

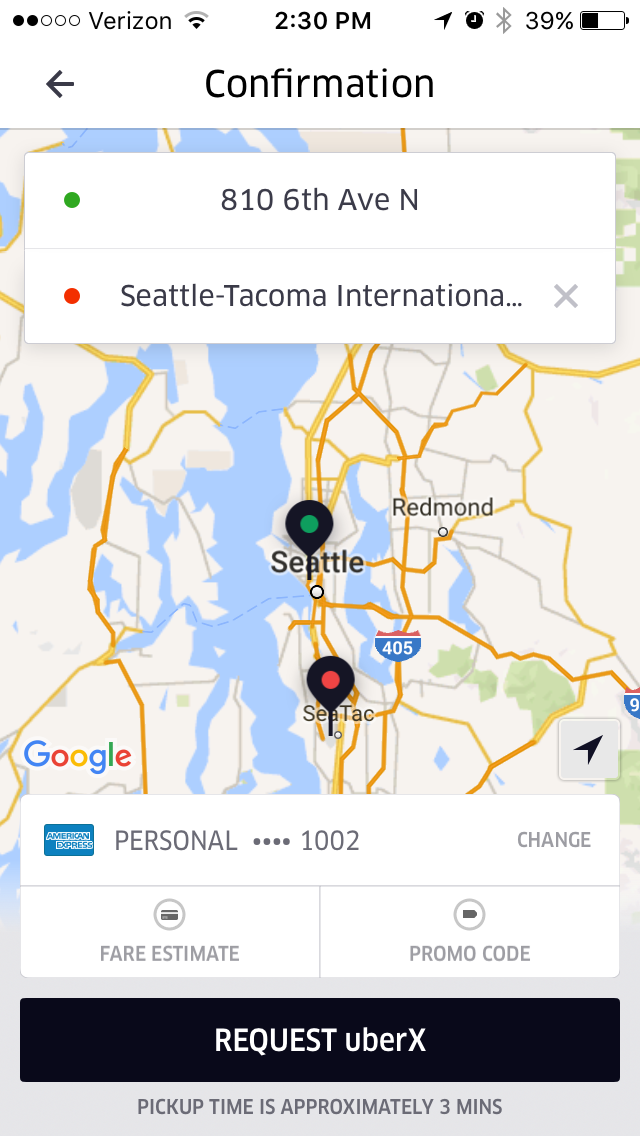

Here's how to do it.

First, download the Uber app and sign up.

It’s free to sign up (another full disclosure - that’s my referral link. Free ride for you and free ride for me).

Set your pickup location and car type.

When you’re in the app, a map will appear of your general location. Type in an address for your pickup location or drag the map around until the pin is where you want to be picked up.

The number in the circle is the estimated time to pickup, and the cars pictured are actual nearby ubers.

Select your uber type from the options along the bottom of the screen.

The cheapest option is on the left and the most expensive is on the right (For Hire being the exception. It’s comparable to uberX rates).

A quick rundown on uber types. Note: you'll only see options available in your area. You might not see “uberHOP” or “For Hire” in your view, for example.

Uberhop: Carpool! A commuter option to share an uber for the cheapest fare. Only available along popular commuter routes in metro areas.

UberX: Point A to Point B without a fuss. These are typically sedans from the last ten years and they look fine: no dents, no scratches. They seat four. This is my typical option because it's cheap and functional.

UberSelect: For the fancy pantsys. Expect to be picked up in a nicer car like an Audi, BMW, Mercedes, or Infiniti. They’ll all have leather seats.

UberBlack: For the fantsy pantsys wanting one specific color. Yes, these cars are actually black with black leather interiors. They're typically a bit more expensive than UberSelect and their drivers will be lookin' fly.

UberXL: Great for going to the airport in a carload. These are the bigger version of UberX and seat up to six.

UberSUV: Big car. Big style. Expect Cadillac Escalades, Chevy Suburbans, or GMC Denalis. It's basically UberSelect with six seats.

For Hire: Taxis using uber technology. These are found in very limited areas and pricing is comparable to UberX.

Right then, back to it.

Enter a destination

I always check out the “fare estimate” and this will give you a ballpark of cost.

Close out of the fare estimate and request your uber.

When uber is trying to get more cars on the road, they’ll enact “surge pricing” that makes fares more expensive (and thus drivers make more money). If surge pricing is in effect, you’ll be notified before you pay.

Pickup

After you've requested your uber, you’ll see a profile of the driver, a description of the car, and then you can actually follow the car’s location on the app until it comes to you. The driver may call you just to touch base and clarify pickup details (what corner you’re standing on, an identifying feature, etc).

The driver will pull up, confirm you’re the right person, and then go ahead and hop in! I usually sit in the back rather than the passenger seat, but that's up to you.

Drop off

That's it! Get out and be on your merry way. You don't tip - your credit card will be automatically charged (wizardry technology). You’ll also have the opportunity to rate your driver after the trip is finished.

Use uber...

To/from the airport.

After you’ve had a few too many drinks and can’t drive.

In place of a taxi.

In a city.

To get dropped off at a show with limited parking.

A few things to keep in mind:

Uber has drawn some critics for less-than-stringent driver requirements and liability issues. Know and understand these perspectives, and trust your gut if something feels off.

It does seem that uber is really stepping up their safety with end-to-end insurance for riders and drivers, and riders can also press a button to “share their ETA” with a friend when hopping in for a ride.

Overall, I'm definitely in favor of uber as yet another success of the sharing economy and will definitely be using it again.

*Uber is cheaper than taxis in most major cities. There is not enough room here to show you all the data, but check out this cool map from CNBC for further reading on the price comparison.

This is Part 2 of a sharing series. I’m a big fan of the sharing economy, because it’s clever, cost-effective, and follows the life mantra of “what makes a better story.” It’s not for everyone, but if you’re intrigued, read on!

For those with a chronic case of wanderlust, I highly recommend checking out Airbnb for your next trip, if you haven't already. Airbnb is a website where people can list, find, and rent lodging. They currently have over 1.5 million listings in 190 countries, so you'll have plenty to choose from.

Renting a private room on Airbnb is roughly half the price of a hotel. If you rent an entire place, it's 20% cheaper than a hotel.* Your savings get even better if you're going to an expensive city like NYC, San Fran, or Seattle.

Wham, bam, thank you ma'am (or kind sir)

Book the entire place! Take the already wallet-friendly price and split it up with your traveling companions. Not only does Airbnb give you community space to hang out, everyone could have their own room. Now that's fun.

When you book a whole place, this usually means you have a kitchen and the option to cook when you’re tired of fast food for the fourth day in a row.

With Airbnb, you can stay in neighborhoods with character and really get a feel for the vibe of a place. True story: I stayed in an Airstream trailer in Portland and the hippies at the commune next door were making plum wine in the yard. Now that's local flavor.

Airbnb has more pet friendly options than hotels. If you fall in love with a place but it’s not pet-friendly, just ask. You might have to pay extra for cleaning, but it’ll still be cheaper than dog boarding!

Want to stay in an igloo? A caboose? A boat? A tree house? A yurt? A mansion? Lucky you: they're all on Airbnb! Even if you don’t stay in a place from a children’s book, it’s still a more interesting experience than a hotel.

I’ve also found the well-rated hosts (4+ stars) go above and beyond. During a stay in San Diego, the hosts left beach cruiser bikes and beach chairs for us to use. While visiting Crater Lake, we were greeted with warm chocolate chip cookies and used the hosts' kayaks.

The Sage & Mint recipe for a good first experience on Airbnb:

Well first, you have to sign up. It’s totally free.

Once you have an account, you can start looking at destinations. I use the “wish list” feature quite a bit to save my favorites; it's like a Pinterest board.

Use the filters to limit your search to what is available during your travel.

You can choose to share a room, rent a private room, or rent an entire place. I am partial to booking an entire place, but renting a private room is great for a clutch last-minute cheap stay. Solo travelers - you know what’s up - use your best judgement and err on the side of caution if you end up renting a private room.

To book, you'll either see a lightning bolt next to the price or a "request to book" button. The lightning bolt means you can instantly book just like a hotel. The "request to book" means you'll send a request to the host and they'll confirm the booking.

When you request to book, you’ll write a little note to the owner with your reason for booking. You can keep it short and sane: "Hi, I'm traveling to the area for vacation/visiting family/a Netflix binge and your place looks great!"

The host will pre-approve your request and then you'll actually have the ability to book. You will get an email from Airbnb that says you can now confirm your stay. It will have the price breakdown (number of nights, price per night, cleaning fee, security deposit). You'll actually have to click a button to officially confirm. You pay when the host confirms your stay, and then Airbnb gives the payment to the host when you check in.

6. Time to travel! You’ll get more details about how to get into the place you’re staying before you leave. I’ve used key codes, keys hidden in Yale coffee mugs, and keys under the rug. No big deal.

7. Stay, enjoy, and follow instructions for how to leave the house. You don’t have to do any laundry, but some hosts ask dishes to be in the dishwasher, beds to be stripped, or heat turned down.

8. After your stay is done, you get to review the space and they owner gets to review you as a guest.

9. Start dreaming of your next vacation.

Breakfast: sometimes provided, sometimes not (don't count on it if you’re renting an entire place). It should say on the listing page.

Cleaning: some hosts ask for beds to be stripped, dishes in dishwasher, or heat turned down. You do pay a cleaning fee, so no heavy-duty stuff is required, but I also do tend to take better care of Airbnb places than hotels.

Food in kitchen: When in doubt, probably just don’t eat it. However, cooking supplies/spices and coffee are usually fair game.

Two thumbs up for traveling on Airbnb. The whole experience, from browsing to booking, lets you dream and get excited about your vacation. It’s so much more captivating and connecting that just renting a hotel room. Sure, sometimes a predictable Hyatt is just right for a vacation. For the other times, give Airbnb a shot.

*Thanks to the folks at Priceonomics - they did way more number crunching than I wanted to and have a fun interactive map.

This is Part 1 of a sharing series. I’m a big fan of the sharing economy, because it’s clever, cost-effective, and follows the life mantra of “what makes a better story.” It’s not for everyone, but if you’re intrigued, check out my posts and give it a whirl (Airbnb as a guest, Rover.com, and Uber reviews coming soon).

The sharing economy isn't breaking news, but I think it is sneaking into the mainstream, and millennials are definitely leading the way. Some people are avid users and some are just getting their feet wet. Whatever side you’re on, I hope you find some useful information from our experiments in sharing.

What we did: rented our house out while we were on vacation.

Why: this was our first vacation with Lola the dog, and I wanted to soften the blow of the cost of dog boarding for a full week (which, in case you were wondering was roughly $200. Yowch. #TrueCostofLolatheDog keeps adding up...she's just so cute).

How: we signed up as hosts on the popular service Airbnb.

Legwork involved:

Total time: roughly 10 hours in total

Note: Airbnb gives the option to either rent a room of your house (so you would still be there) or rent your whole house (so you wouldn't be there). We chose the whole house because our house is small and we figured the hands-off approach would be our preference.

Pros of Airbnb hosting

Extra cash in mah pockets. Airbnb only takes a 3% cut from your nightly rate, so if your house rents for $100 a night, well, you can do the math for a multi-night stay. Some lovely retired folks are hosts on Airbnb for the adventure of meeting new people, but I’ll be honest: that’s not me. The best part of making extra money was that we rented our house while we were on vacation, the extra cash flow made the vacation even sweeter (we even had money left over after boarding Lola).

Cons of Airbnb hosting

Hosting is a bit involved the first time with setup. Now that we have the outside lock, the welcome manual, and the posting up, it’s not so bad. Just keep in mind that every time you rent out your house, be prepared for a little hassle: washing dishes before you leave for your own vacation, washing sheets and towels when you come back, that sort of thing. Keep in mind that hosting doesn't mean you just sit back, relax, and earn money: it’s still work.

“You know how some people are huggers and some people aren’t? Hosting is kind of like that. I’m a hugger.”

Another con that will really vary from person to person is how much it bothers you to share your stuff. Some people will get the heebly jeeblies (which is totally fine) about strangers coming into personal space and others just don’t really care. You know how some people are huggers and some people aren’t? Hosting is kind of like that. I’m a hugger.

Additional notes: we had really wonderful first guests. They left the place super clean, were very responsive, and we had no issues whatsoever. Airbnb tries quite hard to make it a good experience for hosts (up to $1 million in insurance coverage if property is damaged or someone tries to sue you). Of course, there are bad apple guests and you have to ask yourself if the money is worth it. For some, it isn't.

We are planning on renting out our house again, but I also think a bad experience would make me stop doing it.

Overall: hosting is a good way to make money, definitely not for everyone.

Want to be a host? Click me! Full disclosure: that's totally my referral link and I totally make money off of you signing up. But then again, so do you. #twinnerwinner

Upon moving to Michigan and obtaining a backyard, the first thing on my list of priorities was to get a dog. Despite my pursuit of all things financially wise and frugal, this may be my achilles heel.

As my dear car guy husband commented, “as much as you want your dog to be cheap, she never will be.” It’s true. I put together a rundown of the actual cost for the first month of ownership. These are the sticker prices of every doggie item purchased, for your future reference.

Note from me:

Yes, I am plagued with intense guilt about how it could’ve been invested wisely. In the name of truth, transparency, and education, I give you the true cost of Lola the dog.

Gasp. I know.

I’d like to interrupt this expense chart to talk about the price of Lola herself. We looked at both shelter animals and purebred Vizslas, and shelter animals are quite a bit cheaper ($150-$300) with many of the additional vaccinations already included. We decided to pay a higher initial sticker price because she was exactly what we were looking for and were willing to pay more upfront for a temperament history, breeder reputation, and a good breed fit for us as a couple (and for reference, if we bought her as a Vizsla puppy instead of her being four years old, she would’ve been twice that). I am in total favor of rescuing animals and totally believe that mutts can be the best dogs. We opted to go a different route because it was my car guy husband's first dog and I wanted it to be as seamless as possible.

That said, even if your dog is a rescue (good job), you're still looking at $500-$1000 in initial doggie expenses!

Oh, and it keeps going.

(they left a very informative vet record)

When you're debating a new pet, make sure you take into account the real cost of having a fuzzy friend. They're wonderful, but just make sure you're capable and ready before taking the plunge. Once you dive in, it's real hard to turn back.

Dear Moneybags Magoo,

My parents are coming to visit, and I’m finally at the age where I actually bring in a paycheck. They’ve always paid for me, but now that I’m making money, should I pay when we go out? How do I handle that transition?

Yours truly,

Flying-outta-the-nest-with-dolla-dolla-billz-y’all

Dear Flying-outta-the-nest-with-dolla-dolla-billz-y’all,

What a considerate question-asker you are! Never expect them to, but always be thankful if they do. If you have the means, buy for them every once in a while. If a dinner tab is too hefty, try taking the family out to ice cream or have them over for dinner at your place.

Dear Moneybags Magoo,

What money topics are off-limits or rude to talk about with friends or family? What if I need money advice?

Email Address

*

Subscribe to Sage & Mint here for updates straight to your inbox.

Thank you!

Warmest Regards,

Not Emily Post

Dear Not Emily Post,

Well, you sure know how to ask tricky questions! It really does depend on your relationship with a person. For things like rent and house prices, it’s a little easier to talk about, because that information is generally public (hello Zillow!). However, it can often come across as rude and invasive to ask questions about salary, car cost, any inheritance questions, and how much a person makes. For the most culturally acceptable manners, in general don’t ask money questions of someone unless the other person brings it up (Moneybags Magoo excluded, of course: learning purposes, you know?).

However, if you are just finding your way into personal finance, do find someone you trust deeply and someone who is good with money to aid you in your decisions (I talk to my wise old tortoise father. He always knows and it is so helpful to get his perspective). Don’t necessarily ask pointed questions about their money, but inform them as much as you feel comfortable to get their wise sage advice.

Dear Moneybags Magoo,

What should I say when a friend asks me how much I make? What about when a recruiter asks me in a job interview?

Sincerely,

Cat has eaten my tongue

Dear Cat has eaten my tongue,

If it is a potential employer, avoid giving a number. List the industry average or a range (this benefits you in the salary discussion if they give a number first). If it is a friend asking, be vague or come up with a roundabout answer. A few options if they ask how much you make:

For the snarky:

“Not as much as I wish!”

“Not enough to quit my job and ride on a yacht for the rest of my life.”

“10,000 golden dubloons. The exchange rate is top secret. Sorry.”

For the sincere:

“I’m very thankful for what I make.”

“My salary is decent enough.”

For the direct:

“I’m not comfortable sharing that.”

For the passive:

“How about this weather we’re having?!”

Good luck. Always an awkward turtle, that one.

Send me your money questions! I'm ready for the asking.

Message

*

Dear Moneybags Magoo,

Name

*

Name

Real or fake. I'll never know.

First Name

Last Name

Thank you!

As always, thanks to team savvy for your splendid answers to my invasive money question asking (haha, following my own advice, I see).

Normal 0

false false false

EN-US X-NONE X-NONE

/* Style Definitions */ table.MsoNormalTable {mso-style-name:"Table Normal"; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-priority:99; mso-style-parent:""; mso-padding-alt:0in 5.4pt 0in 5.4pt; mso-para-margin-top:0in; mso-para-margin-right:0in; mso-para-margin-bottom:8.0pt; mso-para-margin-left:0in; line-height:107%; mso-pagination:widow-orphan; font-size:11.0pt; font-family:"Calibri",sans-serif; mso-ascii-font-family:Calibri; mso-ascii-theme-font:minor-latin; mso-hansi-font-family:Calibri; mso-hansi-theme-font:minor-latin;}

When buying a home finally becomes a reality, things can get real crazy real quick. Two months ago I was a renter McRenterson and today I have keys to my very own house and I now enjoy shopping at Home Depot. When my husband’s new job moved us from beautiful, extremely expensive Seattle to the suburbs of beautiful-on-the-inside, very affordable Detroit, the idea of owning a home went from a faraway dream to a very quick reality.

There have been approximately 10,000 things I wanted to write down and say on this subject and in this blog, but I’ve toned down my list so you don’t get scroll exhaustion. Here’s my top five list of surprises/unreal expectations/ “I just didn’t have any clue” on buying a house:

We took the fastest track possible and it still took over a month from when we put in the offer to actually move into the house. We started our house hunt fully approved for a loan (which speeds up the process), put an offer on a house Saturday morning of our house-hunting weekend (June 13), and they accepted it within 24 hours (June 14). It took a full three and a half weeks for the paperwork to go all the way through (we closed on July 2, moved in July 16). Again, this was with a full loan preapproval and my husband sending them every piece of information they needed faster than I can run a mile. With pre-approval (not even full approval), the average mortgage loan takes 30-45 days to complete for a home and even longer for a condo due to a more complicated underwriting process. Get ready to twiddle your thumbs!

I really thought I knew this one before it came, but it really costs so much money! You bring your down payment to closing then, depending how your structure your loan, you bring another couple grand for all the fees and housey-things like taxes, paying for your title, and actually paying the people involved (it was $5K for us but you can read more here for a breakdown). Once you move in, especially if you’re moving in to a bigger space, chances are you’ll do some repairs and touchups, buy some new furniture, and make it your own. We moved into a turnkey house and still spent a lot of money making it ours! All this to say, make sure you have enough cash reserves left over. In my very limited experience, I would recommend having six months of living expenses left (and add 10% because moving is more expensive than you'll realize) after your down payment to avoid added stress.

Mortgage rates are how much you have to pay back to the bank. These are a lot like interest rates on student loans and APRs on credit cards (but interest on credit cards is avoidable, whereas house interest isn’t really unless you’re fatty ballin'). With a 4% mortgage rate on a $200,000 house, you’ll end up actually paying $315,000 with a thirty-year mortgage rate (assuming you put 20% down). These rates are the lowest they’ve been in recent memory. Go ahead, ask your parents what their mortgage rate was on their first house. For my parents, their mortgage rate was 14.75% – that means the same $200,000 house would cost $756,823 over thirty years! Also, these numbers change every day and every quarter of a percentage point matters since it manifests over such a long period of time. Also interesting tidbit on mortgage rates: you are able to "lock" in your mortgage rate for a period of time before your loan actually goes through, and you're also encouraged to shop your mortgage rate at different companies.

Yeah, you hear this one A LOT. But it’s true. Where you buy a house is way more important that what the house’s redone kitchen looks like. Think as long term as possible when you’re picking your home sweet home, because eventually you’ll have to sell. You want it to retain as much value as possible (and if you pick a good location, location, location, you’ll have much better chances of making money on your house). A poorly painted house with leaky plumbing can be fixed but your house's proximity to, say, a waste water treatment plant cannot.

Buying a house feels like I’ve officially entered the rat race, the “keeping up with the Joneses.” I wasn’t expecting that. Take as many moments as you need to talk yourself out of a house you can’t afford, just because the breakfast nook is particularly dreamy. Every house has its flaws, and don’t set yourself up to buy the nicest house with the nicest things. Make it your own, make it welcoming, and that’s the best you can hope for in a few walls with a door.

Hi there, I’m Moneybags Magoo. Ask me a question and I’ll pull deep into my pockets of wisdom for an answer.* This month’s theme: housing.

Dear Moneybags Magoo,

Word on the street (slash internet) is to spend 30% or less of income on housing. I'm trying to figure out how much to spend on rent (floor-to-ceiling windows! Granite countertops! Hardwood floors!). Should I try to skimp in this area or can I flirt with the big-chunk-of-income realm? -Sincerely, Apartment Dreaming

Dear Apartment Dreaming,

The short answer for your rental woes: only pay enough in rent to feel safe and comfortable. For most, the ultimate goal is to buy a house (because those monthly payments will come back to your pockets, while renting puts your money in someone else’s pockets). By staying on the lighter side of rent, you’ll save more money for your down payment. If homeownership is not on your radar, the money you save in rent can be invested.

Dear Moneybags Magoo,

I am trying to buy a house, but a down payment would require me to sell all my hair for wigs and also sell my soul. I would really like to buy within the year, but I won't have enough saved within that time for a down payment. I've debated asking my parents to borrow money. Do people actually do this, or should I just pay for the private mortgage insurance (a couple hundred dollars per month)?

Cordially, No Flippin’ Idea What to Do

Dear No Flippin’ Idea What to Do,

First, I would hesitate that you should buy within the year if you can’t afford it quite yet. Let’s apparate back in time to ‘08 and ‘09 with the housing crisis. People bought houses they couldn’t afford. You really want to get into a house with a mortgage you can pay for, because bad things actually happen if you don’t (and think about your mortgage if your significant other loses their job). Ideally, wait until you have that magic down payment.

If you are still considering borrowing money from your parents, many first-time buyers will get assistance in one form or another if their family is in a position to do so. If we’re talking about a loan, it all depends on your relationship with your folks, and you, dear reader, will know best what that looks like. Since both money and family dynamics are involved, even with a healthy relationship and timely payments, this situation has the potential to get really nasty (financial control is a real thing - think about the icy glare from your mother when you buy a morning coffee while still owing them $30K). Dare I say it: any savings you may gain from family borrowing might not be worth the risk of complicating your family ties. Again, you know best if borrowing money from your family is workable.

Dear Moneybags Magoo,

My significant other and I are house hunting. Our Barbie dream house costs a little more than we want to spend. Do you think we would regret buying a more expensive house than a cheaper one? What's a good rule of thumb?

Sincerely, Wishing for a White Picket Fence

Dear Wishing for a White Picket Fence,

This one is easy: buy within your means. You will never regret committing to a mortgage that leaves you sleeping peacefully each night, rather than tossing and turning while thinking about your next mortgage payment. You can buy a bigger house down the road (literally or figuratively), and there will be plenty of opportunities to buy nicer houses as long as you can afford it.

A few notes on house buying for kicks and giggles: whatever number the bank approves you for doesn’t always account for things like eating food and buying gas every day. You don’t have to use the entire loan amount you’re approved for (and you probably shouldn’t. Again, we lived through the recession. Still fresh). Another fun trick: ask the bank about 15-year, 20-year, or even 25-year loans if you have the financial bandwidth for a higher mortgage. You’ll save money by shortening the life cycle of the loan even by a few years.

Also, like many things, you’ll probably end up spending a little more on a house than you planned (between buying new things, fixing up old things, and the sale in general). Plan accordingly! Give yourself some buffer for the added expense. A good rule of thumb: buy a less expensive home in a good location. Time will usually sort that one out nicely in your favor.

*The deep pockets of wisdom are actually an email thread with about twenty ridiculously savvy folks who are generous enough to let me ask pesky personal finance questions. These are gems from their answers, because they know about life and are pretty good at it.

Hi there, I’m Moneybags Magoo. Ask me a question and I’ll pull deep into my pockets of wisdom for an answer.* Keep in mind, these answers are targeted to those in their twenties. Should you be a fairly broke twenty-something (because education is expensive), you get a free pass in how much you can/want to spend. This month’s theme: giving gifts.

Dear Moneybags Magoo,

I’m going to a wedding next month and need to buy a present. I have no idea how much I’m supposed to spend. Help!

Yours truly,

Ignorant Wedding Bliss

Dear Ignorant Wedding Bliss,

Fear not. Let’s start with a good rule of thumb: buy a gift that would cover the cost of your wedding meal. The next question to consider is your budget: are you siphoning a chunk for gifts each month? Are you on a tight budget? Divvy up accordingly, and do your thang. If you just want a freaking number, here you go: shoot for $40-$60 (a wee less if single) and wish them a thousand years of happiness.

Dear Moneybags Magoo,

I have a lot of bridal showers to attend this spring; but I never know how much I should spend on the bride-to-be! What’s an appropriate amount for a bridal shower gift?

Sincerely,

Off to Victoria’s Secret

Dear Off to Victoria’s Secret,

Wedding bells are a ringin’ and boy they can sure get expensive. One thing to consider is if you’re going to the wedding and buying another gift. Think of their price tags together, and then you’ll feel a little more reasonable with spending (and you won’t go broke after a summer with seven weddings). $20-$40 is a great amount.

Dear Moneybags Magoo,

I’m going to my first baby shower this weekend. The only question is, how much should I spend on the small human growing inside my friend?

Regards,

Uncharted Territory

Dear Uncharted Territory,

Fear not! Baby presents are easy. Their clothes are small and generally affordable.$20 is totally appropriate, and maybe $40 if the baby’s mama is in your inner circle.

Dear Moneybags Magoo,

Our friends just bought a house. How do I celebrate this life transition with them?

Cordially,

More Uncharted Territory, Practically in the Yukon

Dear More Uncharted Territory, Practically in the Yukon,

How thoughtful. How considerate! Housewarming gifts are op-shun-all. It’s actually the thought that counts on this one. Bake ‘em some bread (but watch out for the gluten-free folks. Then the thought doesn’t really count), bring flowers, draw a picture for their refrigerator. Should gift-giving be your love language and you just can’t help yourself, $10-$20 on a candle, vase, or other housey thing is just plain delightful.

*The deep pockets of wisdom are actually about twenty ridiculously savvy folks on an email thread who are generous enough to let me ask pesky personal finance questions. These are gems from their answers, because they know about life and are pretty good at it.

Married? In a relationship? You know the sticky feeling of trying to manage finances with another cook in the kitchen. Making money decisions can be more complicated than coq au vin, but it's a necessity in everyday life.

For tips on how to succeed, check out these rules from a couple who have been married for 29 years. This list is hanging on their refrigerator, and although it's not for everyone, it can definitely be freeing for some couples if you make it your own.

Disclaimer (for a second time): These rules aren't the gold standard by any means, though there are some gems in here. Use it as a starting point for your own rules!

Rule No. 1: Agree that neither of you can make a purchase above $75 without first consulting the other. (Sage & Mint note: our limit is $50)

Rule No. 2: Agree that there will be no secret bank accounts, no earnings that are not disclosed, no undisclosed loans and no secret credit cards.

Rule No. 3: Join all your finances together. (Sage & Mint note: you're a team now, act like one!)

Rule No. 4: It should take two “Yeses” for any major financial decision. That means if one of you disagrees with a purchase or an investment, it won’t happen.

Rule No. 5: Budget will be strictly adhered to, except in cases of emergency. (Sage & Mint note: #strugglebus)

Rule No. 6: Budget will be reviewed at the end of each month. (Sage & Mint note: #strugglebuspart2)

Rule No. 7: If fun money ($100 each per month) has been spent, it is spent. There will be no arguing, pouting, name-calling or fighting. (Sage & Mint note: this was a GAME CHANGER for us. Highly recommended.)

Rule No. 8: Personal money does not have to be spent in that month and may be carried over. There is no borrowing against future months.

Rule No. 9: A car fund will be established and money — no less than $50 — placed into it every pay period, to be reviewed after three months. (Sage & Mint note: or a house fund, or a vacation fund, you get the idea)

Rule No. 10: $400 ($200 each) in “magic money” will be allotted out of bonuses, with the rest going to either long-term needs or savings. (Sage & Mint note: love this idea. Brilliant.)

That's it, folks. These rules worked wonders for this couple; you can have your own set, however loose or rigid. The idea is to have a code of reference when those inevitable money disputes break out. Set yourself up for success, and don't forget date night.

This list is created by Judi and Christopher Chesley, put into an article by the amazing Michelle Singletary, and came to me by carrier pigeon from my dad. The world is so connected.

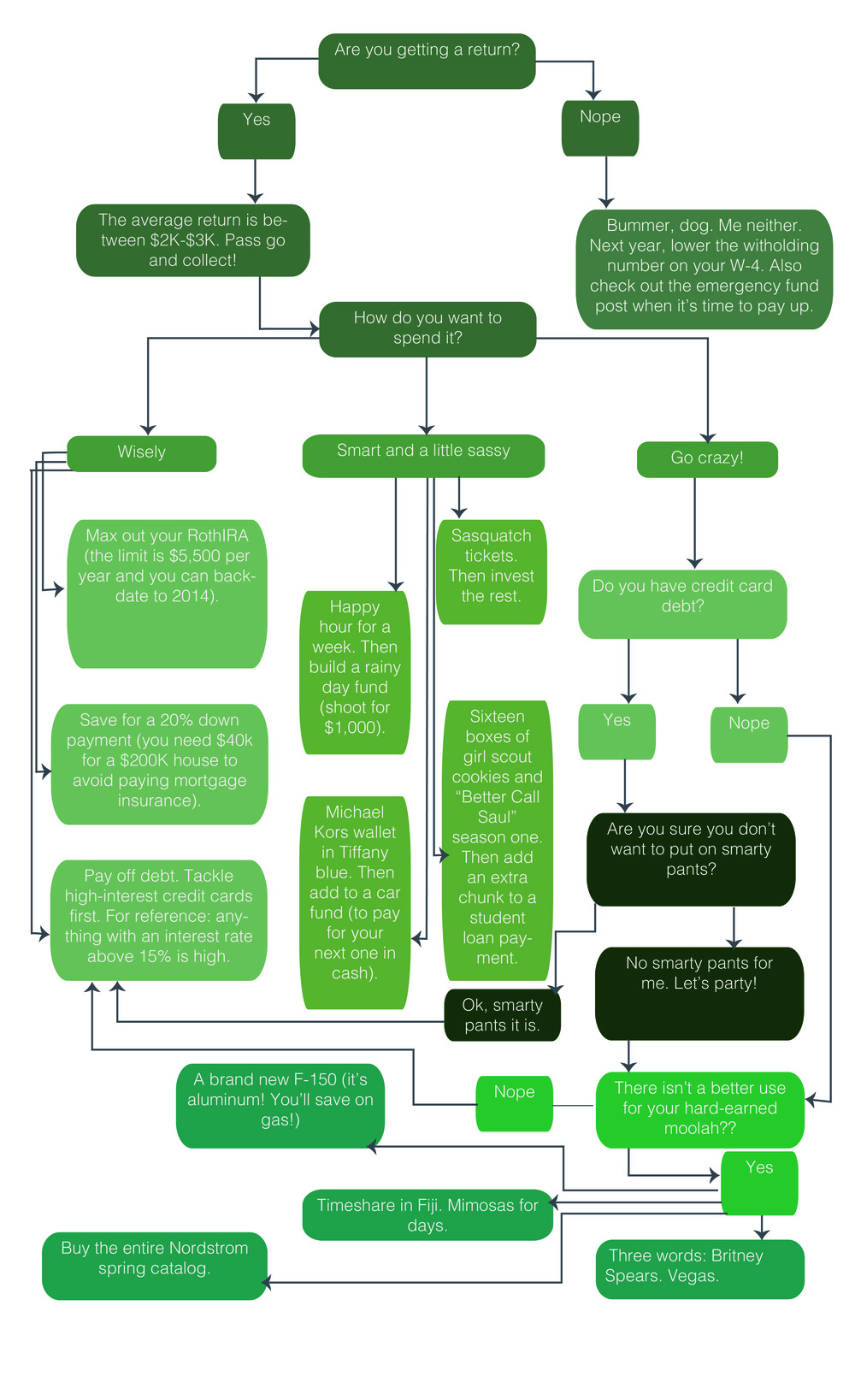

Tax time! Getting a return? Writing a check? Either way, you’ll end up paying the government the same amount each year. It just depends if you want a surprise payout or to pay the government in a lump sum. The goal would be to get your taxes just right; not too much and not too little, but it’s definitely not as fun that way. Check out my post on taxes for more information on filing; the deadline is April 15. For those who have already filed, expect your return within three weeks, and use this flow chart to help siphon your money. Click the image below to enlarge.

This month’s installment is a funzie-wunzie introduction to The Wise Sage. Each segment will feature an older, wiser sage giving money advice to all y’all.

This month’s wise sage: my very own father. He’s the kind of guy that has other people's children named after him, and he gives advice on which you can base your life decisions. Plus, he reads approximately 3,204 pages of news per day, much of that including economics and personal finance, so that helps too.

We also lived on one income on purpose. We ended up saving more money than some couples that were living on two incomes. It’s pretty tempting to spend a lot of money if you’re making a lot of money, so we tried to cut out that mindset.

“It’s pretty tempting to spend a lot of money if you’re making a lot of money, so we tried to cut out that mindset.”

Also, we were pretty frugal on our car purchases. A car is a depreciating asset (it’s more likely to lose its value) while a house is an appreciating asset (it’s more likely to make you money).

“A car is a depreciating asset while a house is an appreciating asset.”

*Italics added for emphasis.

It was a little over a year and a half ago when I lost my job. It was a mass layoff in our smallish office, and my whole team was cut. There was definitely a hug line on the way out, and some of the recently unemployed were stuffing their pockets with snickers bars to use the rest of their monthly snack balance before handing in their cards. It felt like a scene out of a movie, and I was the unfortunate soul bussing home at ten in the morning, my purse stuffed with a pencil cup and a file organizer.

That bus ride started a six-month period of unemployment that I wouldn’t wish on anyone but I wouldn’t take back either. Here are a few tips I’ve collected should you ever find yourself in a similar situation.

What to do if you lose your job:

The actual numbers: expect a bit less than half of your monthly take home pay. In Washington on a salary of $40K, you would see roughly $1400/month in unemployment. This continues for six to eight months (depends on the state) and stops once you get a job.

To actually file, just Google it. You’ll find a semi-clunky government website with instructions. For Washington, it looked like this:

I had to fill out an online 10-question survey each week to get my straight-into-my-bank-account deposit. The most noteworthy qualifications: did I look for work that week, and did I apply to at least three jobs. The website encourages you to keep a log of the actual jobs you apply for, but no one ever asked to see mine (and should they, I still have it—all 52 pages).

If you can opt to have taxes withheld, do it (usually around 10%). This makes it a bit easier rather than paying taxes in a lump sum later.

Are you under 26? Stay on your parents’ insurance!

COBRA: don’t know what it actually stands for, but you can pay (usually a small fortune) to stay on your insurance from your old job.

Obamacare/Affordable Care: the cheaper (and harder to sign up for) version of COBRA.

A store of six to nine months of living expenses comes in handy, but if you don’t have this stocked away we won’t dwell, we’ll just move on and make it work (and don’t make the same mistake twice).

Are you in a tight financial bind already? It might be time to move in with the parents or get a roommate. Save yourself some money-related stress (though no guarantees it won’t add other kinds of stress during this time).

Trim the fat. Call Verizon to plead your case. Cut the cable for the next few months. Eat in. Put yourself on a spending freeze.

Allow yourself some cheap adventures. You might not have a ton of money, but you are rich in time, my friend. See where the wind takes you, and remember: rice and beans are filling but cheap, and PB&J is hard to get sick of.

Some ideas to get you started: Have your parents visit! Go to lots of museums! Take a roadtrip! Vacation with a good friend! Go camping! Take up biking! Go to the park for a lazy afternoon! Dream a little here.

Something to watch for: some of your friends (and sometimes strangers) will be extraordinarily kind and generous during this time. Thank you, Katherine, Becca, and Gams. I can only try to pay it forward with such graciousness.

There you have it. Hope for the jobless. Unemployment isn’t exactly great, but it’s not so bad either. Cheers and wishing you the best in unemployment!

Think of your credit score as a game—slightly silly and somewhat illogical. You see, credit is not a measure of your Richie Richness, it’s a measure of your financial reliability (snore). Banks and lenders use this number (somewhere between 300 and 850 on the standard scale) to determine how much money they should lend you (if any at all). The higher your credit score, the better.

Right then, so how do you move from bad news bears to rockstar status?

Listen close, grasshopper:

C’mon, this one is easy: AUTO-PAYMENTS. Technology does the remembering for you.

It might not be your favorite word, but credit card companies like to see a history of on-time payments. This also leaves room for a catch-22 of credit—if you don’t have credit, it’s hard to get! A tip for those in this boat, get a store credit card like Macy’s or Walmart to start out—these have laxer approval requirements. Another workaround is to get a bank credit card. If you have a good chunk of change in your bank, some will give credit based on income and current savings.

This isn’t Pokémon, friends, you don’t have to catch ‘em all. Two to three cards are probably enough.

This might just be magic juju hullabaloo, but I’ve heard this wisdom passed around a few times. Something about debt-to-credit ratio? We’re just playing the game.

It’s not an extension of your income. Try REALLY hard not to use it as a crutch when you don’t have enough in your bank account. Interest sucks.

These come in the form of student loan debt, mortgages, and car payments. By making consistent payments on these additional lines of credit, you’re showing history and trustworthiness.

Don’t know your credit score? You’re entitled to one free check a year.

Everything in moderation. EVERYTHING.

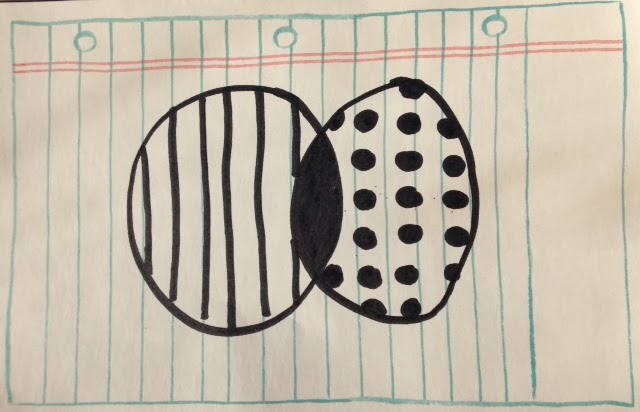

How you spend your money and divy up the budget is no exception. Sammy the saver is good at stocking away a down payment and retirement, but he's a bit of a tightwad when it comes to day-to-day expenses. Stew the spender is good at throwing lavish parties and taking instagram-worthy vacations, but he struggles with putting the shackles on his wallet.

Whether prone toward saving or spending, try erring on the unnatural side just for a bit. There are benefits to spending money and benefits to saving money, and you'll never know the other side until you give it a whirl.

When it comes down to it, money is just a tool. Once we learn the finer points of spending, saving, and making our money grow, then we'll have the foresight to know when it's appropriate to tip with a $20 bill and when we should skip the out-to-eat meal altogether.

Cheers in your money spending and saving!

...And with that, our 10 money tips come to a close!

Want a refresh? Check out the links below.

#1 Don't Spend More Than You Earn

#3 Track Your Day-to-Day Spending

#5 Drive a Used Car – Part One